-

Slots - Pragmatic Play

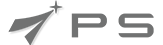

- PG Slots

- Hacksaw

- Habanero

- MicroGaming

- Jili

- No Limit City

- Reel Kingdom by Pragmatic

- AdvantPlay

- Joker

- Spade Gaming

- Funky Games

- Live22

- Playstar

- Spinix

- Crowd Play

- Bigpot

- VPower

- Worldmatch

- Fachai

- Slot88

- ION Slot

- AMB Slot

- Mario Club

- Dragoonsoft

- Fun Gaming

- Naga Games

- JDB

- CQ9

- Only Play

- Top Trend Gaming

- Netent

- Big Time Gaming

- Red Tiger

- Skywind

- Playtech

- Yggdrasil

- Play'n Go

- Real Time Gaming

-

Togel -

Poker -

E-Sports

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ID

-

ENGLISHENGLISH

-

BHS INDONESIAINDONESIAN

-

한국어KOREAN

-

中文CHINESE

-

日本語JAPANESE

-

ไทยTHAI

-

မြန်မာစာBURMESE

-

ខេមរភាសាKHMER

-

हिन्दीHINDI

-

தமிழ்TAMIL

-

తెలుగుTELUGU

-

Tiếng ViệtVIETNAMESE

-

বাংলাদেশীBENGALI

-

PortuguêsPORTUGESE

-